nebraska sales tax rate by city

FilePay Your Return. The Nebraska state sales and use tax rate is 55 055.

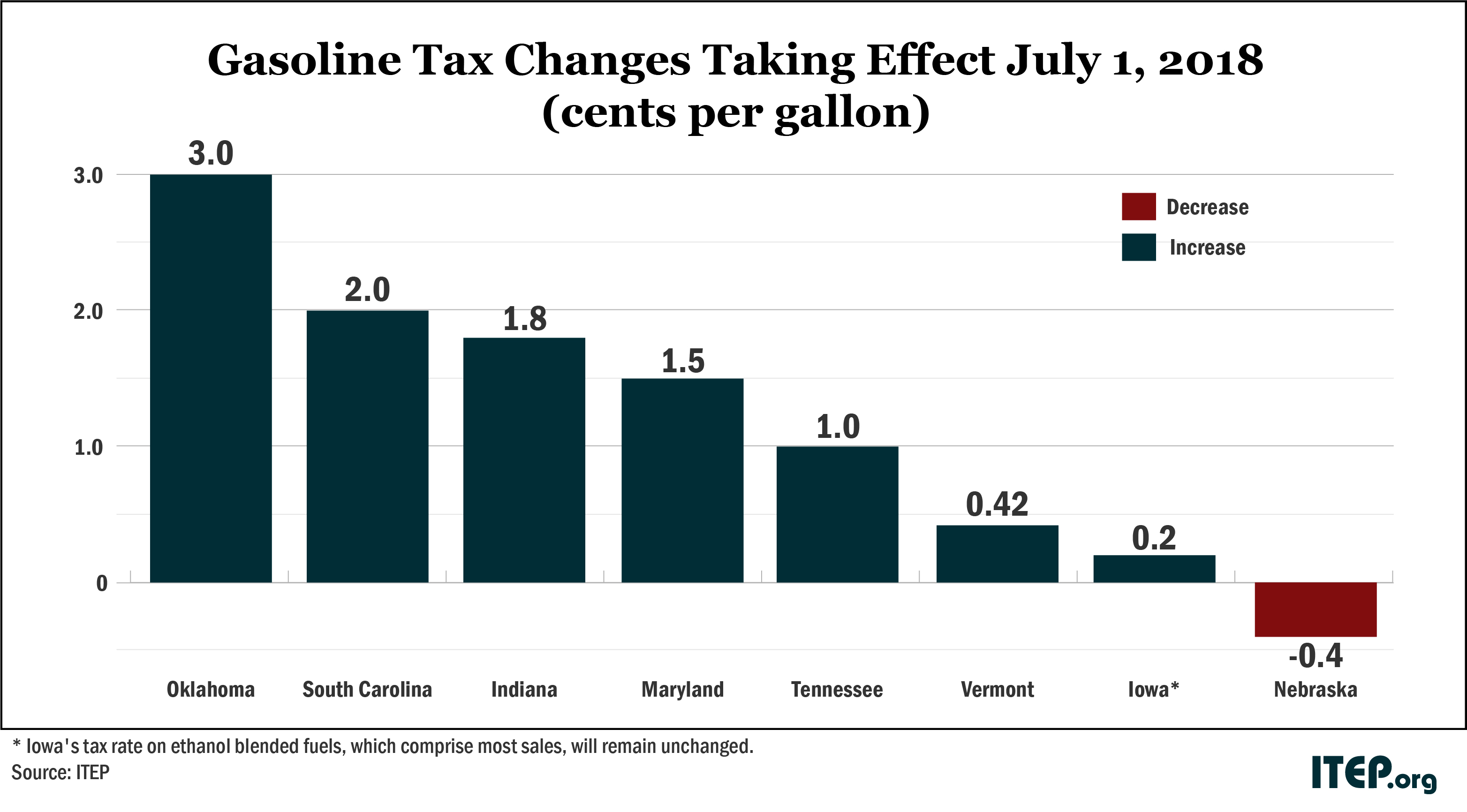

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep

Sales Tax Rate Finder.

. The minimum combined 2022 sales tax rate for Nebraska City Nebraska is. This is the total of state county and city sales tax rates. Nebraska has a 55 statewide sales tax rate but also has 337 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0832.

Counties and cities can charge an. What is the sales tax rate in Dakota City Nebraska. The minimum combined 2022 sales tax rate for Aurora Nebraska is.

Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax. Printable PDF Nebraska Sales Tax Datasheet. When calculating Nebraskas sales and use tax determine the taxes the local jurisdiction charges for the city and county then add those percentages to the state sales tax percentage of 55.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. This is the total of state county and city sales tax rates.

Beaver City 10 65 065 141-040 03495 Beaver Crossing 10 65 065 226-041 03530. What is the sales tax rate in Omaha Nebraska. It is the states most expensive county with a property tax rate of 23094.

The Nebraska state sales and use tax rate is 55 055. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967.

Groceries are exempt from the Nebraska sales tax. Nebraska sales tax details. Municipal governments in Nebraska.

This is the total of state county and city sales tax rates. 536 rows Nebraska City and Locality Sales Taxes. The minimum combined 2022 sales tax rate for Dakota City Nebraska is.

The Nebraska NE state sales tax rate is currently 55. As of June 30 the states total sales tax rate was 16 with the city of Beatrices tax rate being 8. The Nebraska City Nebraska sales tax is 550 the same as the Nebraska state sales tax.

Local Sales and Use Tax Rates Effective April 1 2021 Dakota County and Gage. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. NE Sales Tax Calculator.

Cities or towns marked with an have a. The base state sales tax rate in Nebraska is 55. While many other states allow counties and other localities to collect a local option sales tax.

The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax. This is the total of state county and city sales tax rates. What is the sales tax rate in Aurora Nebraska.

CountyCity Lottery Keno Frequently Asked Questions. The Nebraska City Nebraska sales tax is 750 consisting of 550 Nebraska state sales tax and 200 Nebraska City local sales taxesThe local sales tax consists of a 200 city sales. Find your Nebraska combined state.

While many other states allow counties and other localities to collect a local option sales tax. Sales and Use Taxes. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75.

The minimum combined 2022 sales tax rate for Omaha Nebraska is. What is the sales tax rate in Nebraska City Nebraska.

Ricketts Wields Veto Pen Says Nebraska Needs To Save Money For Tax Cuts Nebraska Examiner

Nebraska Sales Tax Exemptions Agile Consulting Group

Historical Nebraska Tax Policy Information Ballotpedia

Nebraska Sales Tax Sales Tax Nebraska Ne Sales Tax Rate

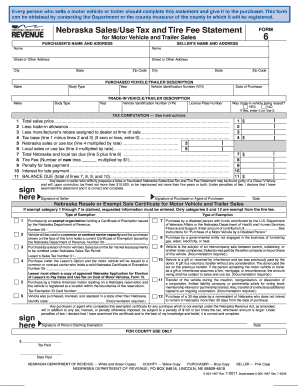

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

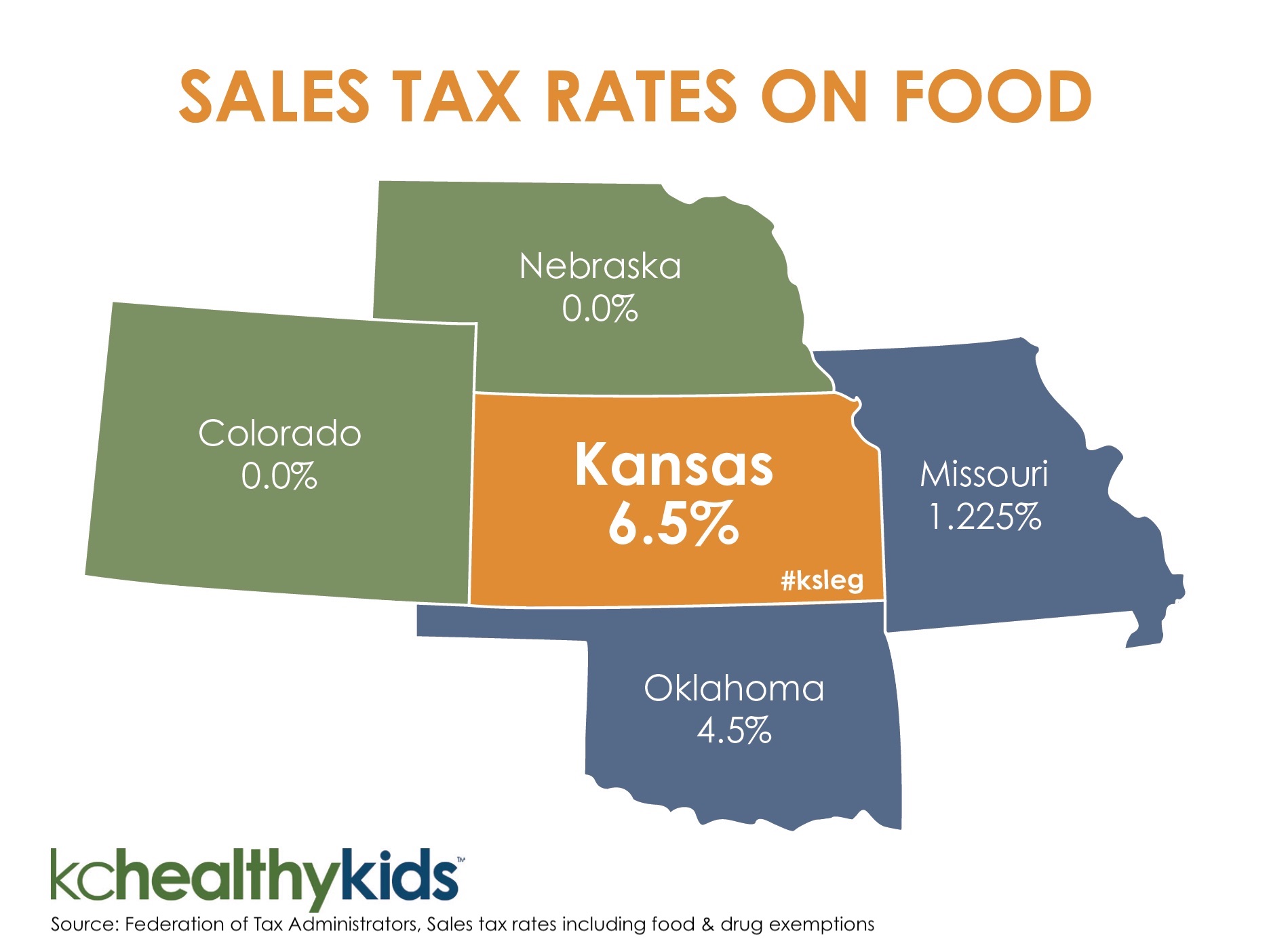

Kansas Food Tax Highest In Nation

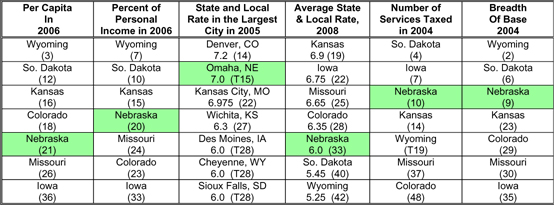

Taxes And Spending In Nebraska

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

Nebraska Income Tax Calculator Smartasset

Gasoline And Diesel Tax Rates In Nebraska 1997 2010 Statista

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

State Lodging Tax Requirements

Form 6 Nebraska Sales Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 Fill Out And Sign Printable Pdf Template Signnow

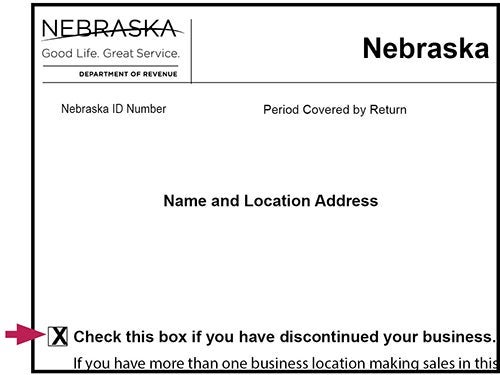

Closing Your Business In Nebraska Nebraska Department Of Revenue

50 Years Ago Nebraskans Aroused To The Point Of Fury Over Taxes

Proposed Bill Would Add New Income Tax Bracket In Nebraska Kptm

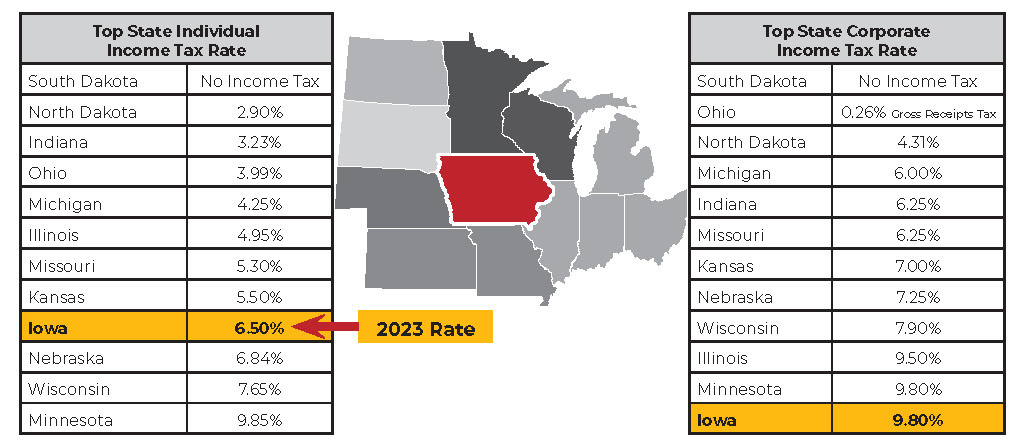

Iowa Still Has High Income Tax Rates Iowans For Tax Relief

.png)